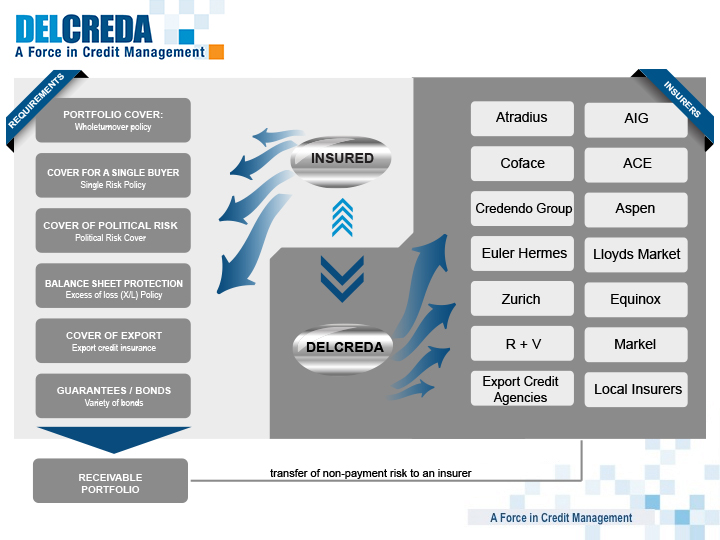

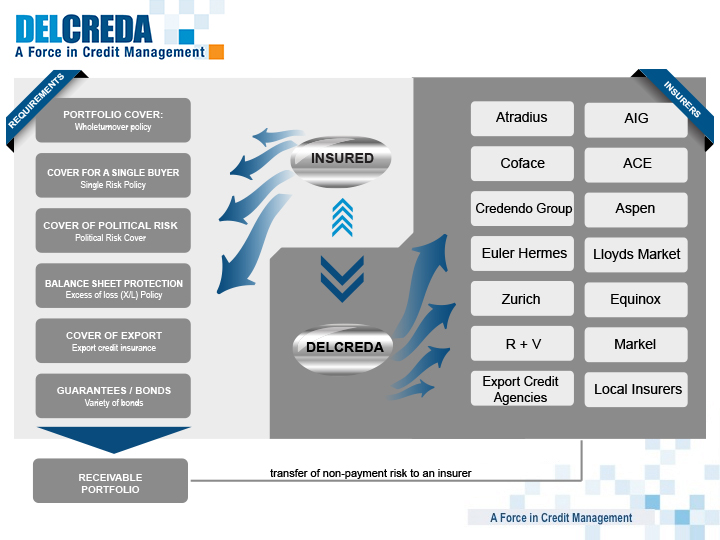

The solutions to ensure receivables are numerous, and they differ from country to country… there is also a difference between domestic coverage from private insurers and export coverage from the government agency.

To use this instrument to protect your business in a correct and effective way it is recommended to consult a professional broker who advises in the day to day administration of the policy.

We offer our experience of combined more than 25 years in this special segment:

- Intensive analysis of needs and requirements of the prospect

- Work out a fitting policy arrangement

- Negotiations with the insurer regarding optimal coverage

- Support in achieving adequate credit limits and acceptance ratio

- Assistance with the implementation of a policy

- Training of the employees in charge of the day today handling of the policy

- Advise in day to day business, especially in the fulfillment of all obligations of the insurance policy

- Management of the prolongation of the contract or rearrangement of the cover concept

Credit insurance

Trade Credit Insurance brokerage is a very specialized service, and as the service is continuously upgrading differently in different countries there is a wide range of product variations, clauses and also obligations. Always depending on the individual company needs this applies among others to:

- Policy coverage

- Domestic, export / definition of insurable portfolio / single risk cover / short term, medium term

- Type of premium

- Turnover premium: on insured clients / on insured turnover

- On balance outstanding: from insured clients / from insured receivables

- On credit limits

- Fixed

- Franchises

- Self retention (10-20%)

- Each and every loss

- Threshold

- Annual aggregate

- manufacturing risk cover, seasonal credit limits, top up cover, run in- run off cover, …

Single risk coverage

Single risk/buyer project coverage in high-risk countries: cover of commercial, political and pre-shipment risk, the unfair calling of bonds as well as contract frustration cover.

For bigger single risk projects Delcreda follows a different approach for its client’s requests:

- Collecting Information: reports, financials and ‘story’

- Analysis: making the first evaluation if the potential buyers are insurable for the requested amounts => increases the probability of getting an offer

- Finding the fitting insurer(s): private and/or state-owned (ECA) insurers